“We saved $2.3M in procurement last year.”

The CFO looked at me, waiting for congratulations. Instead, I asked: “So where is it?”

He blinked. “What do you mean?”

“In your financials. Where did the $2.3M show up? Because your EBITDA only improved by $400K.”

The room went silent.

This conversation happens more often than you’d think. Every year, procurement teams across industries deliver impressive savings reports. PE firms and boards celebrate the wins. Leadership teams feel accomplished. Yet EBITDA remains stubbornly flat, or grows far less than the savings projections suggested it should.

The uncomfortable truth? Most procurement savings evaporate somewhere between the spreadsheet and the P&L statement.

The Invisible Leak

In my work with SMBs and PE portfolio companies, I’ve seen this pattern repeatedly: a company invests significant time and resources into strategic sourcing initiatives. They hire consultants or build internal procurement capabilities. They negotiate hard, secure favorable terms, and report substantial savings.

Then... nothing changes in the actual financial performance.

The savings vanished.

Not because the negotiations failed. Not because the suppliers reneged. But because the hardest part of strategic sourcing isn’t the negotiation—it’s ensuring the savings actually stick.

Why This Happens: The 5 Leakage Points

After working on strategic sourcing transformations across industries—from manufacturing to healthcare to technology—I’ve identified five places where procurement wins consistently evaporate:

1. Scope Creep Amnesia

You negotiated a 15% discount on office supplies based on a defined list of items and projected volumes. Great work.

Three months later, someone adds “specialty items” to the approved purchase list. Then “one-time project needs.” Then “executive requests.” The list that was supposed to be static has expanded by 40%.

The math becomes brutal: 15% savings × 140% volume = a net increase in spend.

A medical device company negotiated excellent pricing on surgical supplies. Within six months, the approved SKU list had grown from 200 items to 340. The “savings” turned into increased costs, but the procurement team’s dashboard still showed green because it only tracked per-unit pricing, not total category spend.

The underlying issue: Nobody defined—or enforced—what was included in “the scope.” And nobody was watching for scope expansion post-negotiation.

2. The Implementation Gap

This is perhaps the most common leakage point I encounter.

A new contract gets signed with a preferred supplier. The terms are favorable. Everyone agrees to use this supplier going forward. The contract sits in the legal department.

Meanwhile, in the actual workflow:

The old supplier is still in the purchasing system as “approved”

Buyers continue using familiar vendors out of habit

Requisition templates still default to previous suppliers

Nobody communicates the change to the people actually placing orders

Six months later, you discover your “preferred supplier” has captured only 60% of the category spend. The other 40% is still going to the old, more expensive vendors because the path of least resistance didn’t change.

A regional healthcare provider negotiated a comprehensive contract with a medical supply distributor that should have generated $800K in annual savings. A year later, actual savings: $240K. Why? Because 70% of their locations never updated their ordering systems to default to the new supplier. Buyers were still using the old vendor because “that’s how we’ve always done it.”

The underlying issue: The negotiation team handed off a signed contract, but nobody owned the operational implementation. The workflows, systems, and habits didn’t change to reflect the new reality.

3. The Volume Variance Ghost

Strategic sourcing negotiations typically include volume commitments: “If we commit to X units per year, you’ll give us Y% discount.”

The contract gets signed based on projected volumes. Then reality intervenes.

Scenario A: Volumes don’t materialize. Maybe the market shifted. Maybe the product line didn’t perform as expected. Maybe a project got delayed. You’re now paying for volume commitments you didn’t use, or worse, paying penalty rates for falling below minimums.

Scenario B: Volumes increase—but at old contract rates because nobody updated the tiered pricing in the purchasing system. You’re buying more, but not capturing the volume discounts you negotiated.

Scenario C: Volumes shift between product categories, and suddenly you’re hitting minimums in the wrong places while missing discounts in others.

A manufacturing client negotiated volume-based pricing on raw materials. Their forecast assumed steady production. Then they won a major contract that doubled volumes in one category while halving another. The net result? They paid penalties in the low-volume category and missed additional discounts in the high-volume one because the pricing tiers weren’t restructured mid-year.

The underlying issue: Volume assumptions are set-and-forget. Nobody tracks actual vs. projected volumes post-deal, and nobody has authority to renegotiate when reality diverges from projections.

4. Death by a Thousand Exceptions

“This project is special.”

“This client has unique requirements.”

“We need this ASAP and the preferred supplier can’t deliver in time.”

Each exception seems reasonable. Each one is small. But they add up.

In organizations without strong procurement governance, exceptions can reach 20-30% of category spend. At that point, you don’t have a strategic sourcing program with some exceptions—you have chaos with some compliance.

One company had 43% of their IT equipment purchases classified as “urgent exceptions” that bypassed the preferred supplier program. When the root causes were examined, most were simply convenience (”easier to order directly from this vendor”) or relationship-based (”we’ve always worked with them”).

The procurement team’s carefully negotiated enterprise agreements were being undermined by hundreds of small decisions that seemed insignificant individually but collectively destroyed the business case.

The underlying issue: No clear governance around who can approve exceptions, under what circumstances, and with what accountability. Every exception is justified locally but never evaluated for its aggregate impact.

5. The Workflow Bypass

This is the most insidious leak, because it happens with the best intentions.

Your strategic sourcing team negotiates a new contract that requires a new approval workflow. Maybe it’s to ensure compliance. Maybe it’s to capture better data. Maybe it’s to involve stakeholders who weren’t previously consulted.

The workflow is logical. It makes sense on paper. There’s just one problem: it’s too complex or too slow for the operational reality of your business.

So teams find workarounds:

Splitting purchase orders to stay under approval thresholds

Classifying purchases in different categories to avoid the workflow

Using corporate cards for purchases that should go through procurement

Going direct to suppliers and processing paperwork after the fact

Your strategic sourcing win just got commoditized back into tactical buying—except now you’ve added administrative overhead without capturing the savings.

A technology company implemented a new procurement workflow that required seven approvals for purchases over $10K. Well-intentioned, but it added 12-18 days to procurement cycle time. Within three months, project managers learned to split $50K purchases into five $9,900 requisitions. The workflow was followed (technically), but the strategic pricing was lost because the volume wasn’t aggregated.

The underlying issue: The workflow was designed for control, not for enabling the business. When workflows become barriers, people find ways around them—and your strategic sourcing value disappears.

The Real Cost

These leakages aren’t small. Industry data suggests that 50-70% of negotiated procurement savings fail to reach the bottom line.

Let me make that concrete:

For a company with a $50M annual spend base, strategic sourcing should generate $2.5-5M in savings (5-10% is typical). If 50-70% leaks away, you’re losing $1.5-2M per year.

Over a three-year PE hold period, that’s $4.5-6M in lost value creation.

And here’s the truly frustrating part: you’re paying for this failure. You’re investing in strategic sourcing teams, consultants, or technology platforms to generate savings that never materialize. The savings are real in the negotiation room—they’re just not real in your financial statements.

Why Smart Companies Still Fail at This

If the leakage points are this obvious, why do smart companies with capable teams still struggle?

Because they optimize for the wrong outcome.

Most procurement organizations optimize for the negotiation, not the implementation. Success is measured by:

Number of contracts signed

Percentage discount secured

Savings “on paper”

The procurement team is incentivized on “savings signed,” not “savings realized.” Their dashboards show green. Their performance reviews are positive. Everyone moves on to the next category.

Meanwhile, the actual financial performance tells a different story—but finance doesn’t have visibility into what procurement committed to, so they can’t reconcile the gap. Operations teams were never truly aligned on the strategic sourcing decision, so they continue working the way they always have. And the technology stack doesn’t enforce the new contract terms because nobody invested in the systems integration required.

There’s also a tragic irony at play: the harder you negotiate, the more complex the implementation often becomes. Volume commitments, tiered pricing, rebate structures, performance penalties—these create operational complexity that has to be managed. If that complexity isn’t embedded into your workflows, it becomes a source of leakage rather than value.

The EDSO Edge Approach: Lock In Your Wins

At EDSO Edge, we don’t just help you negotiate better deals. We ensure the savings actually accrue to EBITDA.

Our approach is grounded in a simple principle: Make the right thing to do the easy thing to do.

Strategic sourcing fails when compliance is hard and workarounds are easy. It succeeds when the preferred path is also the path of least resistance.

Here’s our systematic approach:

Phase 1: Honest Accounting

We start by auditing the last 12-24 months of “savings claims” against actual financial performance. This isn’t about assigning blame—it’s about understanding reality.

We answer questions like:

What savings did procurement report?

What actually showed up in the P&L?

Where is the gap, and what’s causing it?

Which leakage points are most significant in your organization?

This diagnostic phase typically takes 2-4 weeks and creates immediate clarity. Often, it’s the first time finance and procurement have had a shared fact base about savings realization.

The output is a prioritized roadmap: which leakage points to fix first based on financial impact and implementation feasibility.

Phase 2: Workflow Integration

This is where most strategic sourcing initiatives fail, and where we differentiate.

We don’t just hand you a contract. We redesign your procurement workflows to make compliance natural:

Technology enablement: If the preferred supplier should be used, make them the default in your purchasing system. Don’t rely on buyers to remember or choose correctly.

Eliminate friction: If the new workflow adds steps, we find ways to remove equivalent friction elsewhere. The net experience should be neutral or better, never worse.

Clear escalation paths: When exceptions are genuinely needed, there’s a fast, transparent process. When they’re not justified, the friction is intentional.

Data capture: The workflow automatically captures the data needed to track compliance, volume variances, and realized savings—without creating extra work for users.

The goal is elegant: design workflows where doing the right thing is easier than doing the wrong thing.

Phase 3: Governance That Works

Governance often gets a bad reputation because it’s associated with bureaucracy and control. But effective governance is actually about clarity and accountability.

We establish:

Clear ownership:

Who owns volume assumptions and is accountable when they don’t materialize?

Who is responsible for price compliance and investigating variances?

Who has authority to approve exceptions, and what’s the process?

Who reconciles procurement savings claims with actual financial performance?

Real-time visibility:

Dashboards showing realized vs. projected savings, updated monthly

Alerts when category spend goes to non-preferred suppliers above threshold

Volume tracking against commitments with early warning flags

Exception logs with business justification and approval chain

Monthly reconciliation:

Procurement savings tracker reconciled against actual spend data

Variance analysis with root cause identification

Corrective action plans for categories not performing as expected

This isn’t about creating more meetings or reports. It’s about creating feedback loops that catch problems early, when they’re still fixable.

Phase 4: Incentive Alignment

Human behavior follows incentives. If your incentive structure rewards “savings signed” rather than “savings realized,” you’ll get exactly that—impressive PowerPoint decks with disappointing financial results.

We work with leadership to align incentives across functions:

Procurement incentives: Tied to realized savings verified by finance, not just negotiated savings. Often a two-tier structure: signing bonus for contract execution, larger bonus for sustained savings realization.

Operations incentives: Include procurement compliance metrics as part of performance evaluation. If you’re a plant manager or department head, your bonus partially depends on using preferred suppliers.

Finance role: Closes the loop with quarterly savings verification. Procurement doesn’t grade its own homework—finance validates the results.

This isn’t about creating an adversarial environment. It’s about ensuring everyone is rowing in the same direction, toward the same definition of success.

Phase 5: Continuous Monitoring

Strategic sourcing isn’t a “set it and forget it” initiative. Markets change. Volumes shift. Suppliers perform or underperform. Your approach needs to adapt.

We implement continuous monitoring systems:

Supplier performance tracking: Are suppliers meeting quality, delivery, and pricing commitments? When they don’t, there’s a structured performance management process.

Volume variance analysis: Flag when actual volumes diverge from projections by more than 10-15%. Trigger renegotiations or adjustments before the variance compounds.

Category health checks: Quarterly reviews of high-spend categories to ensure savings are sustained and identify new opportunities.

Lessons learned: What worked? What didn’t? How do we apply those lessons to the next category?

The companies that excel at strategic sourcing treat it as an ongoing capability, not a one-time project.

The Outcome

When we restructure strategic sourcing for operational excellence, clients typically see:

80-90% savings realization (vs. industry average of 30-50%)—meaning the savings actually show up in EBITDA, not just in procurement reports.

12% average reduction in overall purchased part cost that’s sustainable and compounds over time.

Sustainable gains that don’t erode in year two or three because the workflows and governance are embedded in how the company operates.

EBITDA impact that makes the CFO smile—because for the first time, the procurement savings story and the financial performance story align.

A Real Example

A major industrial manufacturer struggled with chronic savings evaporation. Their procurement team was talented and worked hard, but savings consistently failed to materialize.

The challenge wasn’t negotiation skills. It was organizational integration.

The approach started with an honest assessment: where were the leakage points? The answer was everywhere—but especially in workflow bypass and implementation gaps. Buyers were using old suppliers because it was easier, and the new CPO lacked the organizational authority to enforce change.

The solution involved:

Coaching the purchasing managers on their roles and responsibilities under the new CPO, creating clarity about decision rights and accountability.

Redesigning workflows to embed new contracts into daily operations. Preferred suppliers became the default in the purchasing system, with friction built around exceptions.

Establishing governance around volume tracking and compliance monitoring, with monthly reviews and clear escalation paths.

Aligning incentives so that savings realization, not just savings signed, drove performance evaluation.

The result: 12% average reduction in overall purchased part cost—and it showed up in EBITDA.

Not just in the first year. The gains sustained and compounded because the operational foundation was solid.

The Call to Action

Strategic sourcing without operational integration is just expensive negotiation practice.

You can hire the best procurement talent, negotiate the hardest deals, and report impressive savings—but if your organizational workflows don’t change, you’re building on sand.

The savings will evaporate. The EBITDA won’t improve. And you’ll wonder why your strategic sourcing initiatives aren’t delivering the results you expected.

If you’re generating procurement savings that aren’t hitting your bottom line, let’s talk.

Start with our zero-risk, no-cost Spend Cube Review. In two weeks, you’ll know exactly where your savings are leaking—and what to do about it.

No obligation. No sales pitch. Just clarity.

Email me: amelia@edso-edge.com

Subject line: “Spend Cube Review”

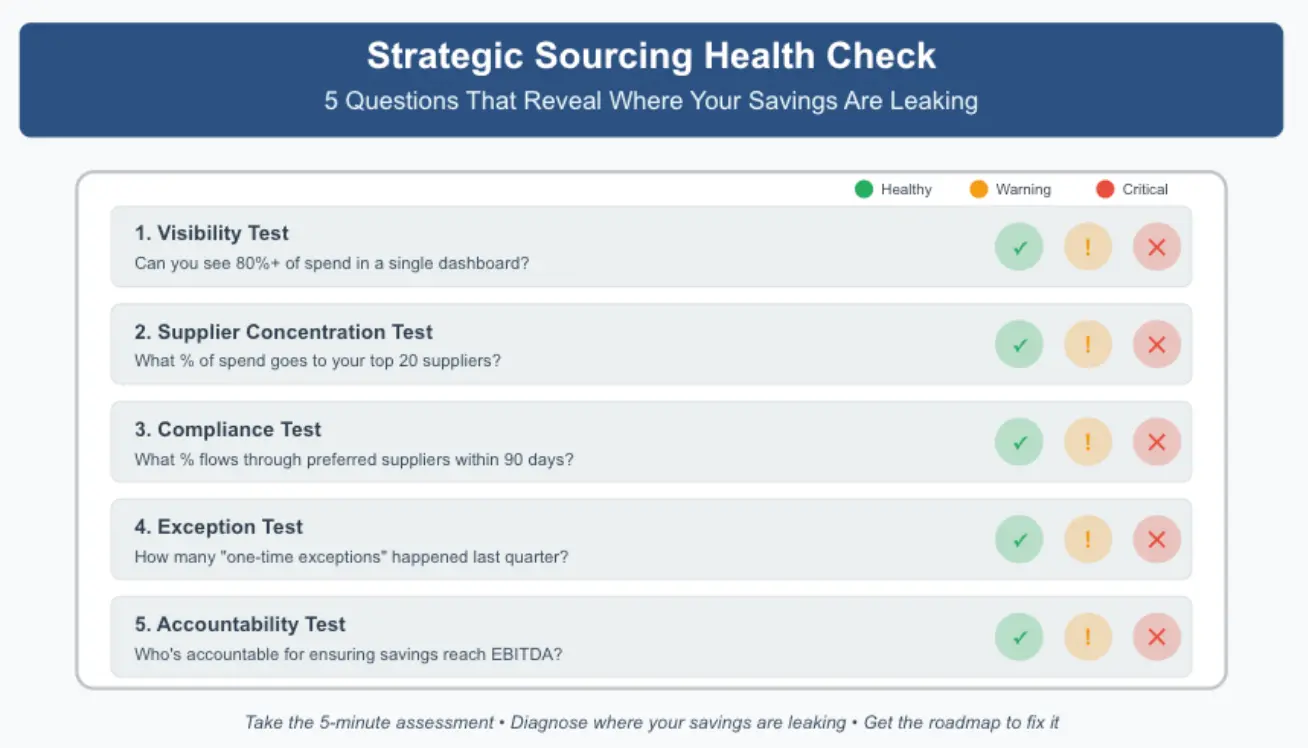

Or take our 5-Minute Spend Cube Health Check to diagnose your strategic sourcing effectiveness right now.

The Bottom Line

Remember: In strategic sourcing, the negotiation is only 30% of the value. The other 70% is in the implementation.

Don’t let your procurement wins evaporate.

Make them permanent.

Amelia Waters is Managing Partner at EDSO Edge, where she partners with SMBs and PE portfolio companies to deliver measurable EBITDA impact through monetization strategy, complexity reduction, and strategic sourcing. With experience at Boston Consulting Group and two decades of operational leadership, she specializes in translating strategy into simplified, scalable operations. Connect with her on LinkedIn or visit www.edso-edge.com.